I recently saw an article from The Dallas Business Journal, and I wanted to share a little of what I learned! I know you’ve heard that businesses are coming here from California, and here’s why. Companies that are making this relocation have cited issues like high taxes, burdensome business regulations and a high cost of living as just some of the reasons for making a move to Texas. The cost difference between California and Texas explained!

Texas has been a magnet for company relocations and expansions for some time. For eight straight years, the state has ruled supreme in the Governor’s Cup rankings produced by Site Selection magazine for total capital investment by state. Now that trend appears to be accelerating because of cost concerns in coastal states as well as the sudden upheaval of the pandemic.

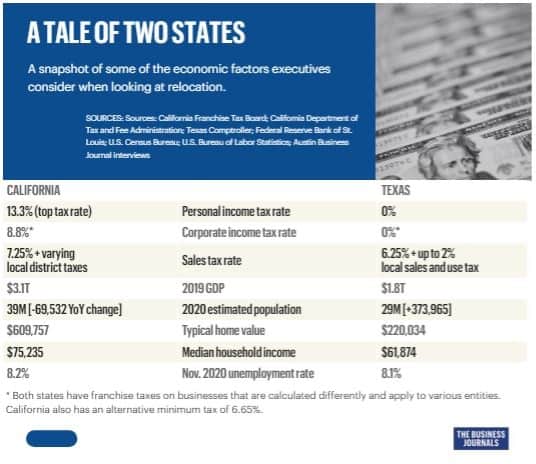

So, as companies trade in California for Texas, it begs the question: What’s the actual cost difference between the two states? On a narrower level, what opportunities does Austin or North Texas provide over Silicon Valley?

Here’s a short graphic to explain:

In this era of cost-cutting, businesses generally save 20 percent on overall costs by making the move from California to Texas. These businesses also save on operating costs such as leasing commercial real estate and payroll. Companies even save on utility costs for their office space.

For both states, the types of taxes and rates vary based on the business, which makes the complete tax picture a bit complex. Income, combined federal and state corporate taxes total roughly 28 percent in California and 21 percent in Texas. That’s not to say businesses don’t pay taxes in Texas — there’s a franchise tax, plus taxes for specific industries. California also has a franchise tax and an alternative minimum tax.

The lack of personal income tax is huge for both businesses and their employees in Texas. It is important to note that property taxes are higher in cities across Texas – 1.93 percent in Dallas County – to help make up for the lack of income tax to fund government services.

This is just the tip of the iceberg on why businesses and people are moving to Texas. I will expand on this in the weeks to come. Please keep checking back!

Beth Brake REALTOR®

Positively changing your life as you move forward to your dreams.

214-769-2947